A Nigerian senator has called on the Central Bank of Nigeria (CBN) to lower interest rate and reduce borrowing from the domestic market in a bid to boost growth in the West African country.

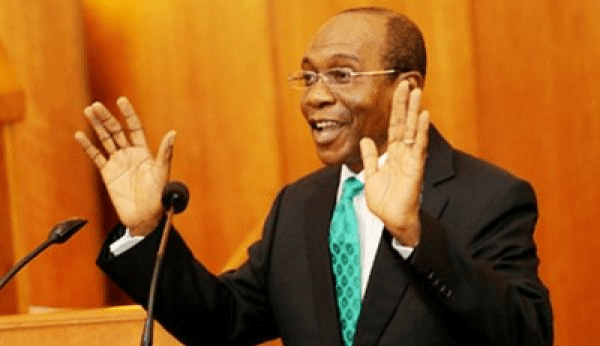

In a motion raised on the floor of the Senate chamber at the resumption of plenary, Senator Yahaya Abdullahi said there was an urgent need to encourage private investment in the economy and ensure sustainable growth.

Abdullahi said the exit from recession was largely due to favourable oil prices d increased domestic production with relative peace in the restive Niger Delta.

Abdullahi urged the government to take steps to improve policies to avoid slipping into another recession, saying that the situation was reversible.

He asked the central bank to focus on its core job of monetary policy and not development finance and coordinate with the government on getting credit flowing to the real sector.

He asked the central bank to focus on its core job of monetary policy and not development finance and coordinate with the government on getting credit flowing to the real sector.

The CBN on Tuesday held interest rates at 14 percent to keep liquidity tight. The bank said it felt that loosening would worsen inflation and drive bond yields negative which could lead to a capital flight and hurt the currency.

Nigeria exited recession in the second quarter of the year as oil revenues rose, but the pace of growth was slow, suggesting the recovery is fragile.

The central bank has spent around $9 billion to defend the local currency, which hit a record-low of 520 against the dollar in February at the black market.

Nigeria exited recession in the second quarter of the year as oil revenues rose, but the pace of growth was slow, suggesting the recovery is fragile.

The central bank has spent around $9 billion to defend the local currency, which hit a record-low of 520 against the dollar in February at the black market.

The local currency has since stable around 305.80 against the dollar on the official market, while it traded at 360 for investors window.

0 comments:

Post a Comment